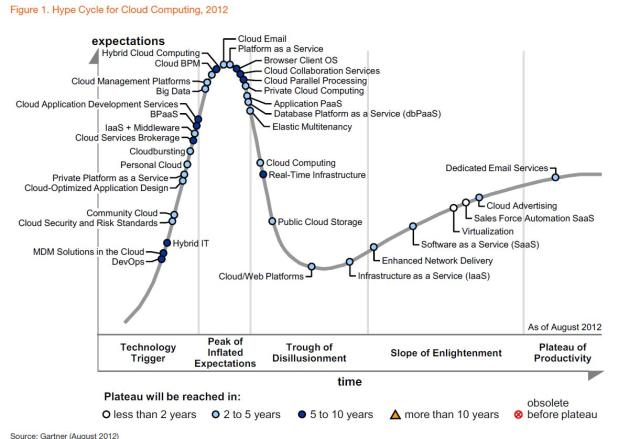

Cloud computing, it means a lot of different things to different people and is one of the most over hyped technologies in all of computerdom. There are public, private, hybrid, infrastructure, software and platform oriented cloud solutions. Crafty software vendors masquerade as cloud solutions, but having a hosted app in rack-mounted hardware for a monthly fee does not constitute a cloud based solution. Gartner has identified no less than thirty-seven cloud-based services and technologies in their 2012 Hype Cycle (see diagram). It’s no wonder Cloud evokes a mind numbing analysis paralysis once you dig below the surface.

Cloud computing, it means a lot of different things to different people and is one of the most over hyped technologies in all of computerdom. There are public, private, hybrid, infrastructure, software and platform oriented cloud solutions. Crafty software vendors masquerade as cloud solutions, but having a hosted app in rack-mounted hardware for a monthly fee does not constitute a cloud based solution. Gartner has identified no less than thirty-seven cloud-based services and technologies in their 2012 Hype Cycle (see diagram). It’s no wonder Cloud evokes a mind numbing analysis paralysis once you dig below the surface.

Yet momentum builds. According to researcher International Data Corporation (IDC), the cloud-enabled Software as a Service (SaaS) market grew 26 percent to become an $18B market in 2012. Cloud infrastructure deployment is predicted to grow to $11 billion by the end of next year. Cloud services are creating a major paradigm shift in business initiatives and IT technology as it offers the potential to leverage vast computational power, storage and a wide variety of application solutions. The choices, pros and cons abound as the financial services industry examines private and public clouds, cost factors, solution alternatives and in the impact on existing business models. As for a definition, this one holds up pretty well.

“Cloud computing is a model for enabling convenient, on-demand network access to a shared pool of configurable computing resources (e.g., networks, servers, storage, applications, and services) that can be rapidly provisioned and released with minimal management effort or service provider interaction.”

“Cloud computing is a model for enabling convenient, on-demand network access to a shared pool of configurable computing resources (e.g., networks, servers, storage, applications, and services) that can be rapidly provisioned and released with minimal management effort or service provider interaction.”

Despite its perceived benefits the capital markets industry has been slow to adopt cloud services or decide what, if any trading-related functions to migrate to a cloud platform. Yet the motivation is mounting, or it seems to be… Market participants are witnessing a new normal defined by thinning margins, increasing competition and diminishing volumes. Extracting alpha out of a dwindling pot has been their raison d’être. The desire to capture alpha anywhere it can be found has caused the uptick in transaction cost analysis (TCA) cost controls, intensified strategy back-testing and cross asset, cross border trading.

Rik Turner from the research firm Ovum recently published a progress report on cloud adoption siting increases have occurred due to improvements in security and overall cost-consciousness. But there is a bewildering array of cloud attributes, many that present challenges to market participants and due diligence is necessary to understand them. The business functions of trading and asset management center on data management. Cloud injects complications for data ownership, entitlements, security, compliance and regulatory policies.

A key characteristic of the cloud is rapid elasticity which offers compute power unheard of prior to cloud technology. Such on demand scalability defines a new archetype for large scale model back-testing. The increasing importance of software testing for both profitability and robustness is a major focus in the post Knight Capital era. The cloud’s pay-per-use access to hundreds even thousands of CPU cores affords in depth testing and optimization techniques that where once impractical.

A move towards cloud signals a fundamental shift in how we handle information, yet at what cost? This is where OneMarketData, the makers of OneTick, a time-series tick database and Complex Event Process (CEP) technology are asking market participants to weigh-in. We have put together a short questionnaire to solicit industry input on cloud computing. Is it a fad or a game-changer?

Click here for the survey on the cloud computing trends in capital markets.

Once again thanks for reading.

Louis Lovas

For an occasional opinion or commentary on technology in Capital Markets you can follow me on twitter, here.

This will really help you to get a proper answer for the role of Cloud Services in Global Markets Trading. Thanks a lot for sharing.